New Rental Relief Framework for SMEs

03 Jun 2020 Posted in Press releases

-

The Ministry of Law (“MinLaw”) is introducing the COVID-19 (Temporary Measures) (Amendment) Bill in Parliament later this week. The amendments seek to provide a rental relief framework for Small and Medium Enterprises (SMEs) and to enhance the relief available for businesses, organisations and individuals who are unable to fulfil their contractual obligations because of COVID-19.

-

The COVID-19 (Temporary Measures) Act (the “Act”), which took effect from 20 April, provides temporary relief from certain types of legal action in relation to the inability to perform certain contracts because of COVID-19. However, businesses are facing financial concerns and uncertainties arising from the unprecedented spread and severity of COVID-19, which has been especially tough on SMEs.

-

The Government recognises that there is a need, in these exceptional circumstances, to take targeted steps to intervene, to help SMEs. Hence, MinLaw will be introducing the following measures, which were formulated in consultation with the relevant agencies and stakeholders from the private sector:

(A) New rental relief framework for eligible SMEs

(B) Relief for tenants unable to vacate business premises due to COVID-19

(C) Cap on late payment interest or charges for specific contracts

Key Amendments

(A) New rental relief framework for eligible SMEs

- SMEs play a critical role in Singapore’s economy. In 2019, SMEs contributed 45% of Singapore’s GDP, and 72% of employment in Singapore. The new rental relief framework aims to help affected SMEs who need more time and support to recover from the impact of COVID-19, by providing mandated co-sharing of rental obligations between the Government, landlords and tenants.

- These measures are intended to establish a baseline position for the handling of tenants’ rental obligations. Landlords and tenants are encouraged to continue to try and work out mutually agreeable arrangements that best addresses their specific circumstances.

(i) Government Assistance for Rental Relief

-

The Government will give about 2 months’ relief of the rental costs of SME tenants (i.e. with not more than $100 million in annual turnover1) with qualifying leases or licences commencing before 25 March 2020, as follows:

-

As part of the Fortitude Budget, the Government will provide additional cash grants equivalent to approximately 0.8 months of rent for qualifying commercial properties, and approximately 0.64 months of rent for industrial and office properties.

-

Taken together with the Property Tax Rebate granted in the Resilience Budget, the Government will provide an equivalent of approximately 2 months of rent for qualifying commercial properties, and approximately 1 month of rent for industrial and office properties.

-

-

To ensure that these measures benefit the intended beneficiaries, the Bill will mandate that SME tenants in qualifying commercial properties receive 2 months’ waiver of their base rental2, and SME tenants in industrial/office properties receive 1 month’s waiver of their base rental.

-

This rental waiver will apply to April and May 2020 for SME tenants in qualifying commercial properties, and April 2020 for SME tenants in industrial/office properties, as long as their leases or licenses are in force on 1 April 2020. These periods correspond to the Circuit Breaker when businesses were clearly impacted by COVID-19.

(ii) Additional Rental Relief to be provided by Landlords

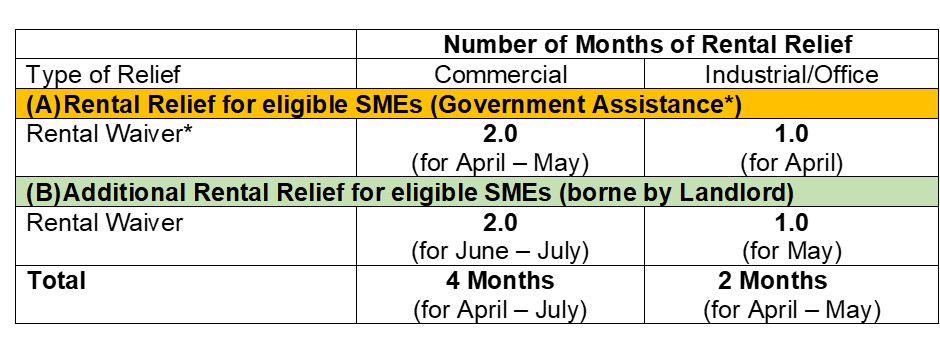

- SMEs who have seen a significant drop in their average monthly revenue due to COVID-19 will receive an additional 2 months’ waiver of base rental for qualifying commercial properties, and an additional 1 month’s waiver of base rental for industrial and office properties (Please see Annex A for eligibility criteria). These additional rental waivers will be borne by the landlord, and will be applied to June and July 2020 for SMEs in qualifying commercial properties, and May 2020 for SMEs in industrial/office properties, as long as their leases or licences are in force on 1 April 2020.

- Taken together, eligible SMEs can thus receive a total of 4 months’ waiver of base rental for qualifying commercial properties, and a total of 2 months’ waiver of base rental for industrial and office properties. The rental waivers can be offset against any previous direct monetary assistance provided by the landlord to the tenant (or subtenant) from February 2020 onwards and/or any passing on of the Property Tax Rebate from the property owner to his tenant. The rental waivers will also apply to eligible SMEs who are subtenants. (Please see Annex B for summary of the total rental relief eligible SME tenants may receive)

- The landlord can apply for an assessment of the tenant’s or (subtenant’s) eligibility for the relief within a specific time. The case will be examined by an assessor, who will ascertain the tenant’s (or subtenant’s) eligibility.

- The landlord may also seek an assessment on the grounds of financial hardship if they are unable to provide the additional rental waiver. This will take into consideration whether his rental income forms a substantial part of his total income and the annual value of his properties. Qualifying landlords will only be required to give half of the additional rental waivers to be provided by the landlords, i.e. 1 month’s waiver of base rental for qualifying commercial properties, and 1/2 a month’s waiver of base rental for industrial and office properties.

(iii) Repayment scheme for rental arrears

-

SMEs that qualify for landlord relief may also elect to serve notice on their landlords to take up a prescribed repayment scheme for a specified portion of rental arrears accumulated from 1 February up till 19 October 20203.

-

Upon serving the notice, tenants must start payment of the first instalment no later than 1 November 2020. Under the repayment scheme, tenants can pay for a specified portion of their arrears over an extended period of time (up to 9 months, or the remaining term of the tenancy, whichever is shorter) in equal instalments, with the interest payable on such arrears capped at 3% per annum.

-

If the tenant fails to make a payment under the statutory repayment scheme, or the tenant terminates the lease or licence, the statutory repayment scheme will be cancelled, and the landlord will be entitled to:

-

Immediate payment of all the arrears

-

Take steps under the contract for rentals not paid.

-

- The new rental relief framework will also be applicable for eligible Non-Profit Organisations (NPOs) and eligible tenants of government properties.

(B) Relief for tenants unable to vacate business premises due to COVID-19

- MinLaw has received feedback that, due to COVID-19, some tenants face difficulties vacating their business premises after their lease or licence comes to an end.

- MinLaw is introducing amendments to the Act to provide relief in such situations. This relief will apply where, due to COVID-19, the tenant is unable to vacate a non-residential property after the end of the lease or licence and before the expiry of the prescribed period (i.e., before 19 October 2020). The tenant must serve a notification for relief on the landlord and meet such other conditions as may be prescribed by the Minister. In such situations, the tenant will not be liable to its landlord, except as otherwise prescribed by the Minister, for failing to vacate the property.

(C) Cap on late payment interest or charges for specific contracts

- The Act provides businesses and individuals who are unable to meet certain payment obligations because of COVID-19 a temporary moratorium from enforcement actions during the prescribed period2 (until 19 October 2020). However, under the Act, arrears continue to accrue and attract late payment interest and charges during this temporary moratorium.

- To provide additional relief in such situations, MinLaw is introducing amendments to the Act to cap late payment interest and charges. This relief applies to arrears that arise due to COVID-19 under specific contracts. Creditors will also not be allowed to terminate such contracts due to late payments during the prescribed period.

- The amendments will be tabled in Parliament on 5 June 2020. If approved, they will be implemented in end-July. Eligible tenants for the rental relief will be notified in due course.

MINISTRY OF LAW

03 JUNE 2020

1. This will be based on Corporate Tax and Individual Income Tax returns for the Year of Assessment 2019.↩

2. Base rent excludes any Gross Turnover payable and maintenance fee and charges for the provision of services such as cleaning and security.↩

3. This corresponds to the prescribed period of relief for non-performance of contractual obligations provided for under the Act.↩

Annex A: Additional rental relief to be provided by landlord eligibility criteria

Annex B: Summary of total rental relief SME tenants may receive

Annex A: Eligibility Criteria for Additional Rental Relief to be provided by Landlords

| Amount of rental relief to be absorbed by landlord | - 2 months of rental waiver for qualifying commercial properties - 1 month of rental waiver for industrial/office properties |

| Eligibility for Tenants | Tenants will need to satisfy all criteria below to be eligible for the mandatory rental relief co-shared by landlords (1) SME at the group level (≤$100 million turnover in 2019); (2) Substantial drop in average monthly revenue during COVID-19 (average monthly revenue from April to May 2020 on an outlet level reduced by 35% or more, compared to April to May 2019) (3) The tenancy must have been entered into before 25 March 2020 |

| Landlord’s Application for Assessment | More details will be available later. |

| Criteria for Assessment | More details will be available later. |

Annex B: Total Amount of Rental Relief Provided

*Owners of qualifying commercial properties will receive approximately 1.2 months through the Property Tax Rebate, and owners of industrial/ office properties will receive approximately 0.36 month through the Property Tax Rebate. The Government will provide additional cash grants approximately equivalent to 0.8 month of rent for qualifying commercial properties, and approximately 0.64 month of rent for industrial/office properties.

Last updated on 03 Jun 2020